Market Snapshot: Denver Luxury Market Trends

This complete snapshot of the latest Denver Luxury Market Trends is essential reading for buyers and sellers in 2025.

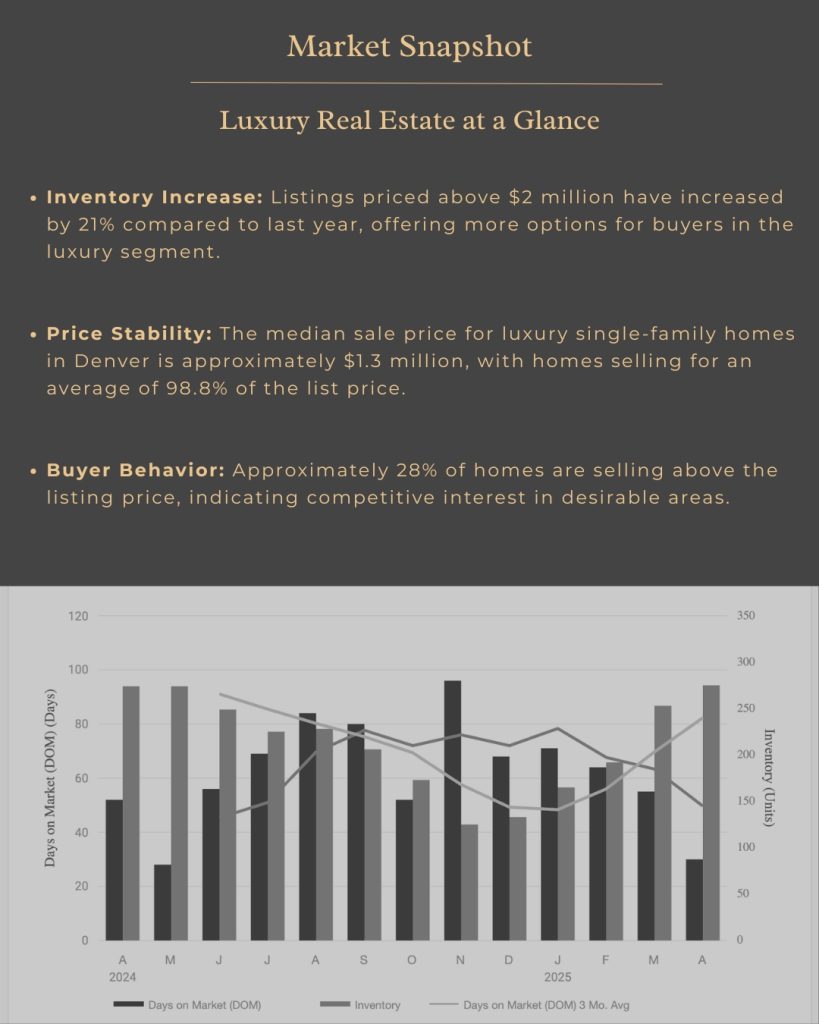

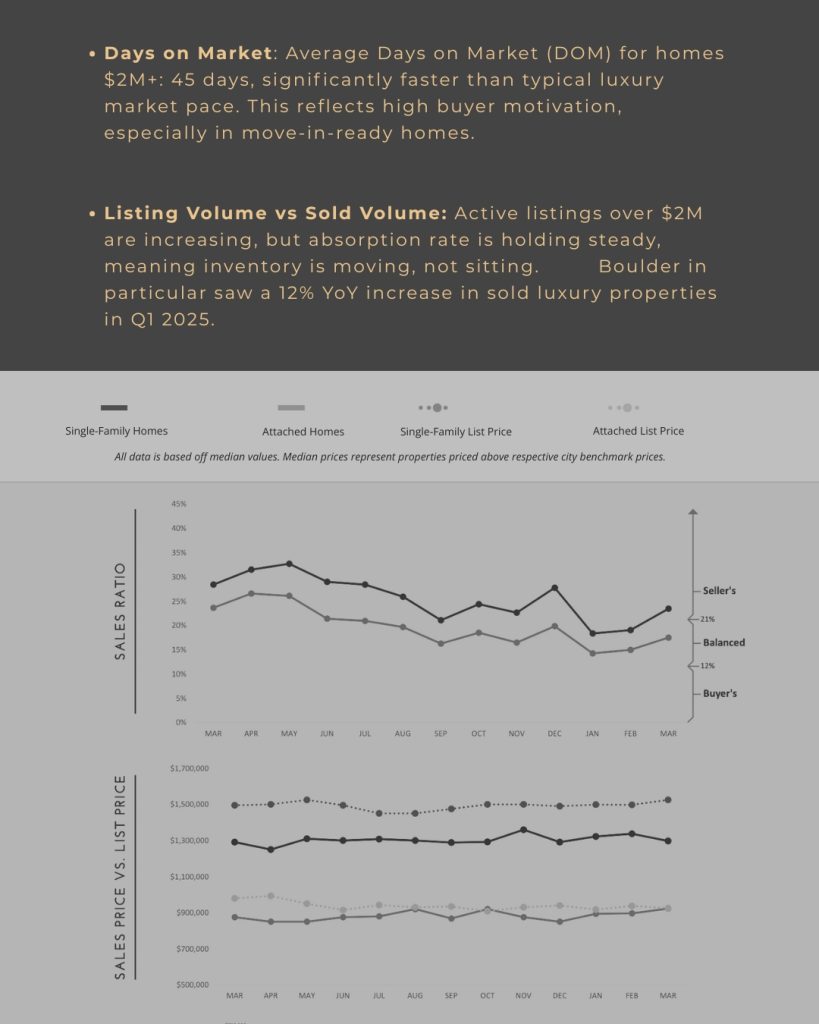

- Inventory Increase: Listings priced above $2 million have increased by 21% compared to last year, offering more options for buyers in the luxury segment.

- Price Stability: The median sale price for luxury single-family homes in Denver is approximately $1.3 million, with homes selling for an average of 98.8% of the list price.

- Buyer Behavior: Approximately 28% of homes are selling above the listing price, indicating competitive interest in desirable areas.

- Days on Market: Average Days on Market (DOM) for homes $2M+: 45 days, significantly faster than typical luxury market pace. This reflects high buyer motivation, especially in move-in-ready homes.

- Listing Volume vs Sold Volume: Active listings over $2M are increasing, but absorption rate is holding steady, meaning inventory is moving, not sitting. Boulder in particular saw a 12% YoY increase in sold luxury properties in Q1 2025.

Lifestyle & Migration Trends

- Increased migration: From high-tax states seeking lifestyle and tax benefits.

- Abundance: Outdoor activities, cultural amenities, quality of life, & sustainability solar, low energy cost.

- Luxury Homes Gaining Traction: Demand for move-in ready or newly renovated homes. Smart home tech, plus lock-&-leave lifestyle + privacy.

- Strong Job Market: Attracting executives, entrepreneurs, and remote talent in:

- Tech & AI (Google, Palantir, startups)

- Finance & Trading (private equity, day traders, hedge fund satellite offices)

- Clean Energy & Biotech (CU Boulder, NREL, sustainable R&D hubs)

- Aviation & Aerospace (Lockheed Martin, Ball Aerospace)

- Remote-first founders (eCommerce, SaaS, coaching, digital agencies)

Wealth Entering the Market

The Rise of Crypto in Real Estate

- Colorado: especially Denver and Boulder, has become a hub for blockchain, crypto, and fintech startups. This naturally attracts high-net-worth crypto holders, many of whom are converting digital wealth into hard assets.

- RealOpen: is leading the charge, allowing buyers to purchase homes with Bitcoin, Ethereum, and other crypto by converting funds instantly into cash for sellers.

- These buyers: are often looking for sleek, modern, tech-enabled homes in vibrant, lifestyle & rich neighborhoods.

- By 2025: Over $1 billion in U.S. residential real estate was purchased using cryptocurrency, a number expected to grow as digital asset regulation evolves.

Stock Traders & Day Traders

- The remote work era: A strong rise of trading platforms like Robinhood, Fidelity, and ThinkorSwim have made it easier for high-income individuals in finance to live wherever they choose.

- Colorado’s blend: The city, ski, and serenity is a natural fit.

- Luxury buyers: Come in with market portfolios, and are often cash-ready and decisive.

- Boulder: Especially attracts those working in biotech, clean tech, and hedge-fund startups.

- In 2024: A third of luxury cash buyers in Boulder County were tied to equity market gains or tech sector bonuses.

The Digital Income Class

Gen Z & Millennials

- They’re young, smart, and liquid.

- From crypto arbitrage to digital products, YouTube channels, and e-commerce brands, many Gen Z and Millennial buyers are entering the market with unconventional wealth.

- Seeking modern, minimal homes or lock-and-leave condos.

- Prefer flexibility, walkability, and tech integration.

- 40% of Gen Z homeowners report earning income from “non-traditional” sources like digital assets, online courses, affiliate marketing, or NFTs.

Strong Buyers Gaining Advantage

Cash is King in the Current Market

- Elevated mortgage rates have sidelined many traditional buyers, especially in the $2M+ range, where rate sensitivity is higher and jumbo financing is more restrictive.

- Cash buyers face less competition and gain stronger negotiating power, often securing price cuts, waived contingencies, or preferred closing timelines.

- In high-end markets like Denver and Boulder, cash buyers closed 37% faster on average.

- Cash offers reduce seller risk, increasing the chance of acceptance, no lender delays, fewer appraisal surprises, and smoother inspection negotiations.

- Cash gives buyers the power to act fast, often beating out higher offers with financing simply due to speed, certainty, and clean contract terms.

- These professionals bring portable, high incomes and are often cash-ready or crypto-capable, driving demand for modern, well-located homes with walkability, views, and access to nature.

Sources & Further Reading

Luxury Home Marketing Report | May 2025

Coldwell Banker Global Luxury Trend Report 2025

RealOpen | Buy Real Estate with Crypto

Built In Colorado – Blockchain Companies

CNBC Real Estate Crypto Coverage

Zillow Gen Z Housing Trends Report

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link